Click below on "Get started Today" listed below

Please follow the directions listed within the form.

Schedule a free 15-min consultation call.

At See Other's Harvest & Win LLC, our mission is to empower individuals with the knowledge, skills, and confidence to navigate the complex landscape of financial literacy. We believe that by cultivating a deeper understanding of personal finance, individuals can sow the seeds of financial success and reap the rewards of informed decision-making. Through innovative education, personalized guidance, and a supportive community, we strive to equip our clients with the tools they need to achieve their financial goals, harvest opportunities, and ultimately win in their journey towards financial well-being. Our commitment is to foster a culture where financial literacy flourishes, paving the way for a brighter and more prosperous future for all.

Disclosure Statement

See Others Harvest & Win (SOHW) we are not financial advisors, accountants, attorneys, or brokers. We do not give legal advice, we are only consultants. We do not do "credit repair", however we do provide assistance enhancing your credit.

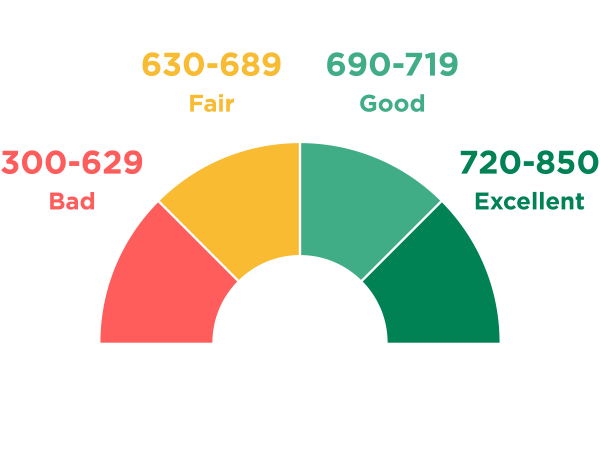

Credit is like your business reputation in the financial world. It's a three-digit number that tells lenders, banks, and other financial institutions how trustworthy you are when it comes to borrowing money. Think of it as a trust scorecard. Now, why does this matter? Well, let me break it down for you. Having good credit opens up doors you didn't even know existed. You want to start that business you've been dreaming about? You'll likely need credit to get the initial funds. You're eyeing that sleek new car? Credit might be your ticket to that sweet ride. Even renting an apartment or getting a phone plan can be easier with good credit. But here's the thing – credit isn't just handed out like candy. You've got to prove you're responsible with borrowed money. Pay your bills on time, manage your debts wisely, and keep your credit utilization in check. Your credit history, length of credit, and types of credit all play a role in building that all-important score.

is a critical aspect of a personal credit profile and holds immense importance when it comes to assessing your creditworthiness. It essentially reflects your track record of making timely payments on your credit obligations, such as credit cards, loans, mortgages, and other debts. This history is documented in your credit report, and it significantly influences your credit score.

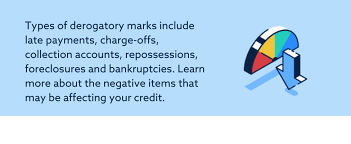

typically stem from non-payment on accounts, but the account may or may not have gone to collections. Collection accounts are a specific type of derogatory mark that indicates an account has been sent to a debt collection agency, usually for failing to pay a debt.

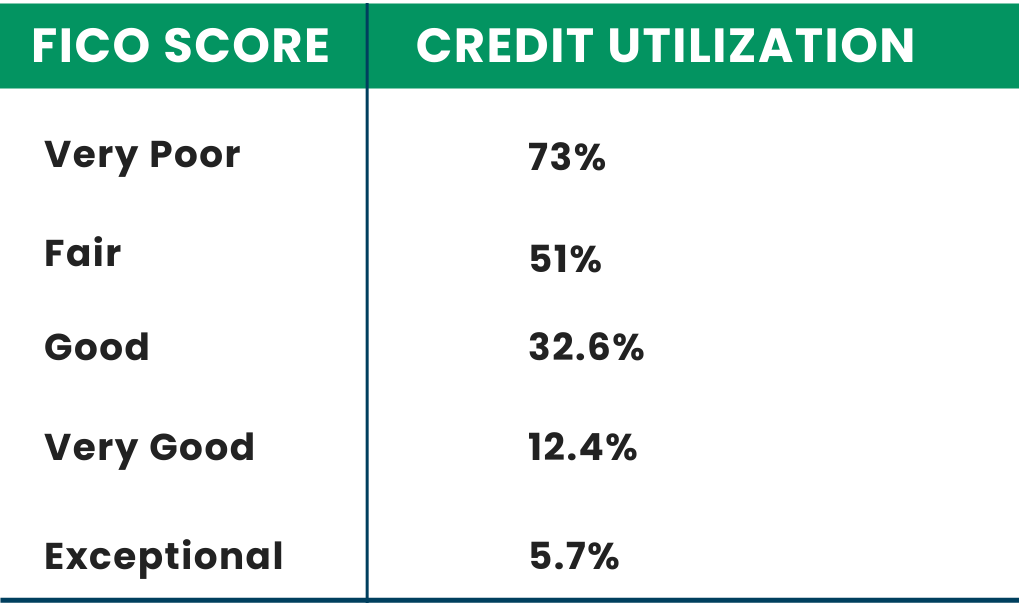

Credit utilization, often referred to as the credit utilization ratio, is a critical factor in understanding and managing your personal credit profile. It represents the percentage of your available credit that you're using at any given time. This ratio plays a significant role in determining your credit score and overall creditworthiness.

Account age is a significant factor in understanding and managing your personal credit profile. It refers to the length of time your credit accounts have been active. This aspect of your credit history is important as it provides insights into your creditworthiness and financial stability over time.

1.) Access to Favorable Interest Rates: A good credit profile enables you to secure loans and credit at lower interest rates. This translates to significant savings over time, whether you're financing a home, a car, or any other major purchase.

2.) Higher Credit Limits: Lenders are more likely to offer higher credit limits to individuals with good credit. This extended credit capacity provides you with greater financial flexibility and the ability to handle unexpected expenses.

3.)Enhanced Borrowing Power: With a good credit profile, you're more likely to be approved for loans, credit cards, and mortgages. This enhanced borrowing power makes it easier to obtain the funding you need to achieve your financial goals.

4.)Better Approval Odds: Landlords, employers, and insurance companies may also check your credit profile. A positive credit history can improve your chances of securing a rental, landing a job, and even obtaining lower insurance premiums.

5.) Negotiation Leverage: When you have good credit, you're in a better position to negotiate terms and rates with lenders. This gives you more control over your financial agreements and ensures you're getting the most favorable terms possible.

6.) Opportunities for Rewards: Many credit card companies offer rewards, cash back, and travel perks to individuals with good credit. This can lead to valuable savings and benefits when you use credit responsibly.

1.) Higher Interest Rates: A poor credit profile can lead to higher interest rates on loans and credit cards. This means you'll end up paying more over time for borrowed funds, increasing the overall cost of your purchases.

2.) Limited Access to Credit: Lenders may be hesitant to extend credit or loans to individuals with low credit scores. This limited access to credit can hinder your ability to make essential purchases or investments.

3.)Difficulty Securing Housing: Landlords often check credit histories when evaluating potential tenants. A low credit score may lead to rental rejections or require you to pay higher security deposits.

4.)Impact on Employment: Certain employers may review credit profiles as part of their hiring process. A poor credit history could potentially affect your job prospects, especially in positions that involve handling finances or sensitive information.

5.)Security Deposits and Fees: Utility companies, cell phone providers, and landlords may require higher security deposits or charge extra fees to individuals with poor credit. This can add financial strain when setting up services or renting a place to live.

6.)Negative Financial Reputation: A weak credit profile can negatively affect your financial reputation and limit your ability to secure favorable terms. This can have a cascading effect on various aspects of your financial life, making it harder to achieve your goals.

Click below on "Get started Today" listed below

Please follow the directions listed within the form.

Schedule a free 15-min consultation call.

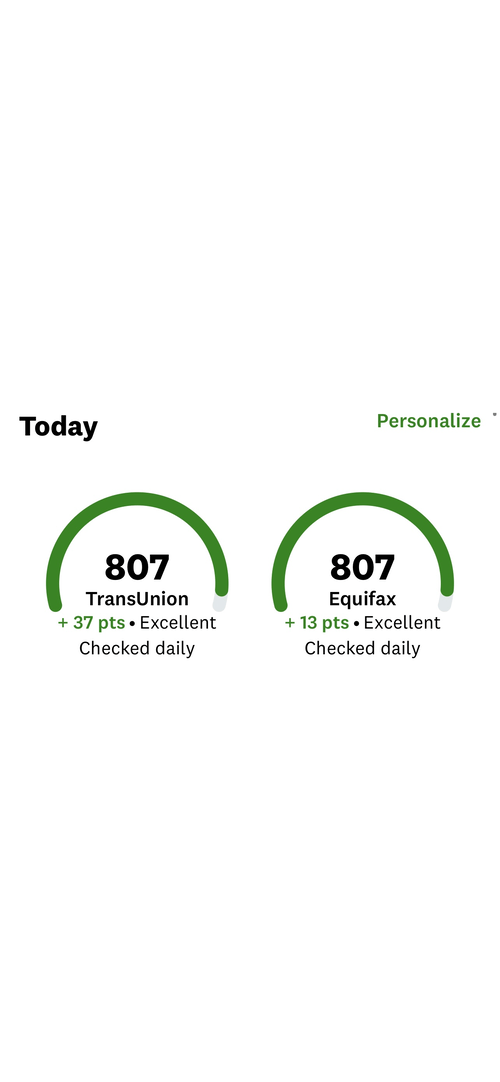

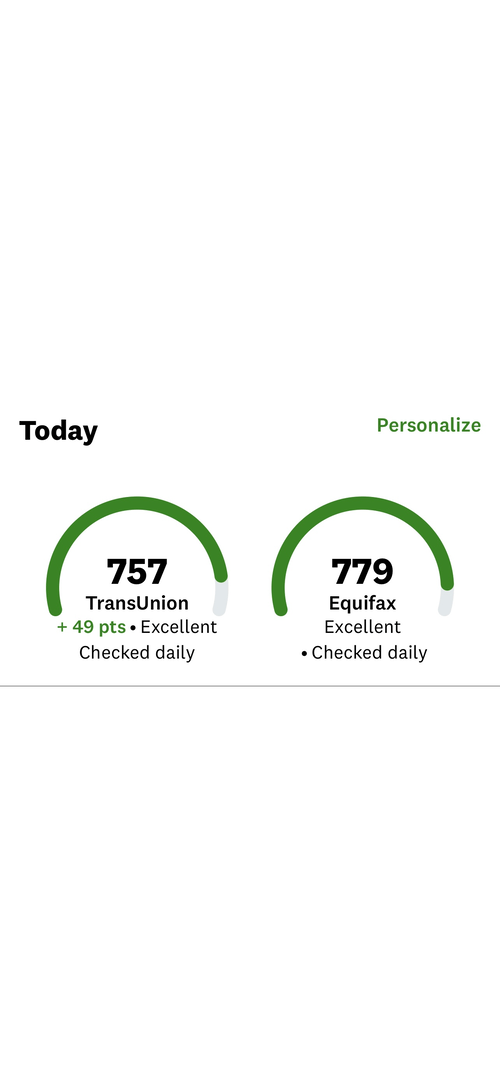

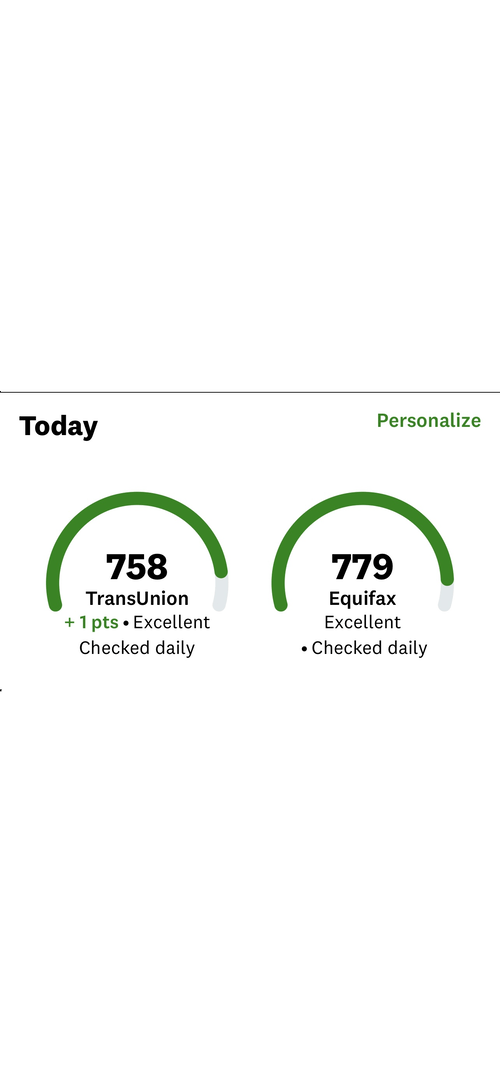

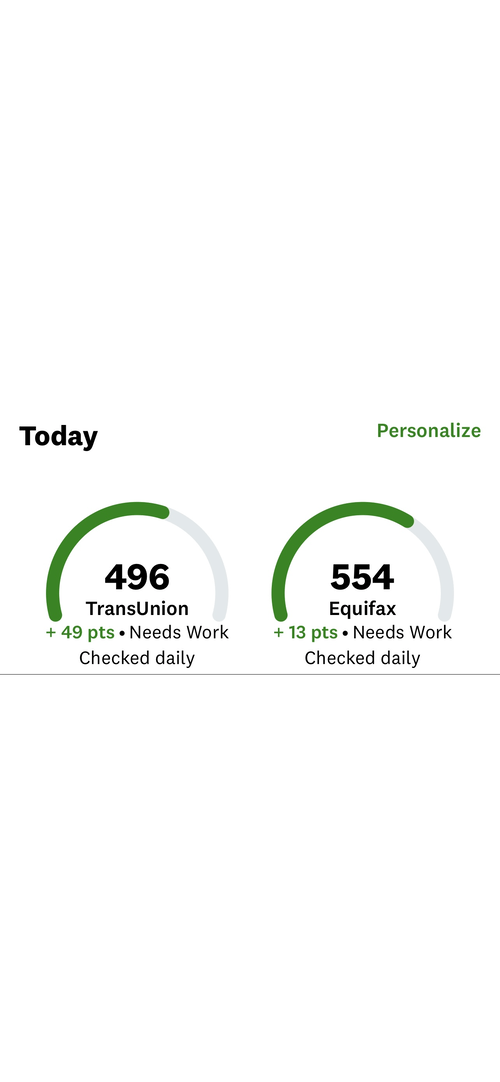

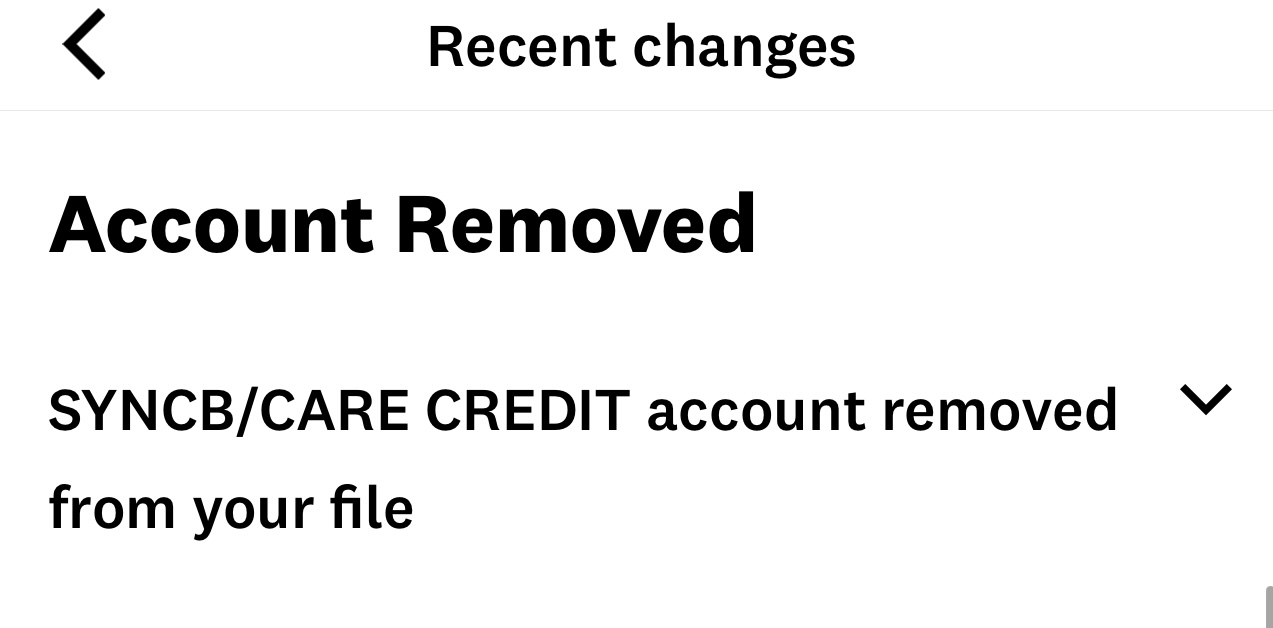

Let's take a view of the results we've

been able to provide to our clients

Hard Inquiry Removed

Late Payments Removed

Collections Removed

Charge-offs Removed

Are you ready to unlock a new beginning?

Take a look of our previous clients results. We never promise, but always deliver.